child tax credit october payments

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season.

. You qualify for advance Child Tax. These monthly payments started in July and will be made through December 2021.

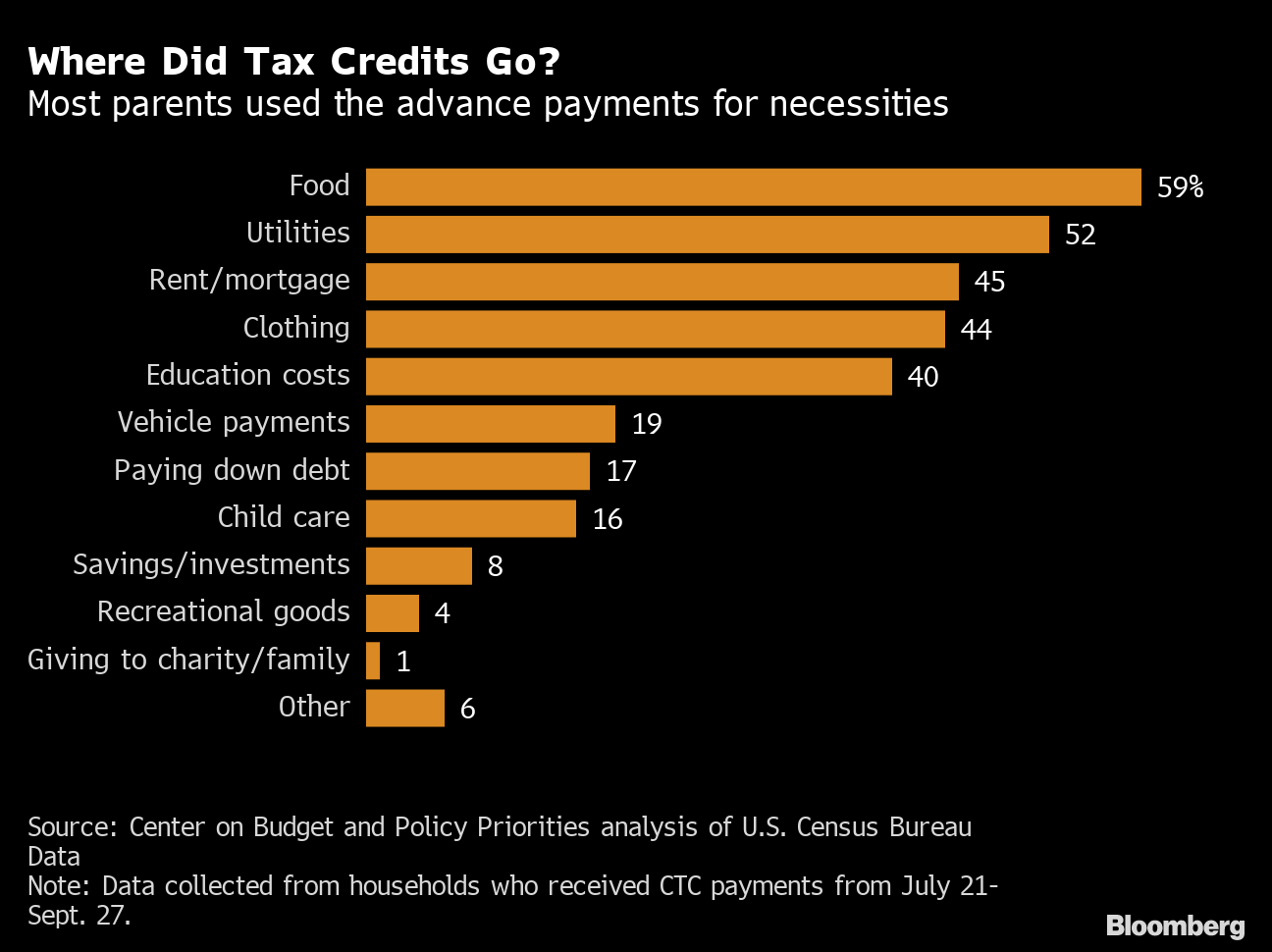

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

What Are Marriage Penalties And Bonuses Tax Policy Center

The Next Deadline For Opting Out Of The Monthly Child Credit Payments Will Be Here Soon Use The Irs S Child Tax Cred In 2021 Child Tax Credit Tax Credits Tax Deadline

![]()

Xpensetracker Is An Expense Tracking Reporting App For The Iphone Ipad This App Emails Or Exports Your Data W Photo Receipts Tax App Iphone Apps Iphone

Child Tax Credit Schedule How Many More Payments Are To Come Marca

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Tax Credits Payment Dates 2022 Easter Christmas New Year

Expiration Of Child Tax Credits Hits Home Pbs Newshour

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

October Child Tax Credits Issued Irs Gives Update On Payment Delays

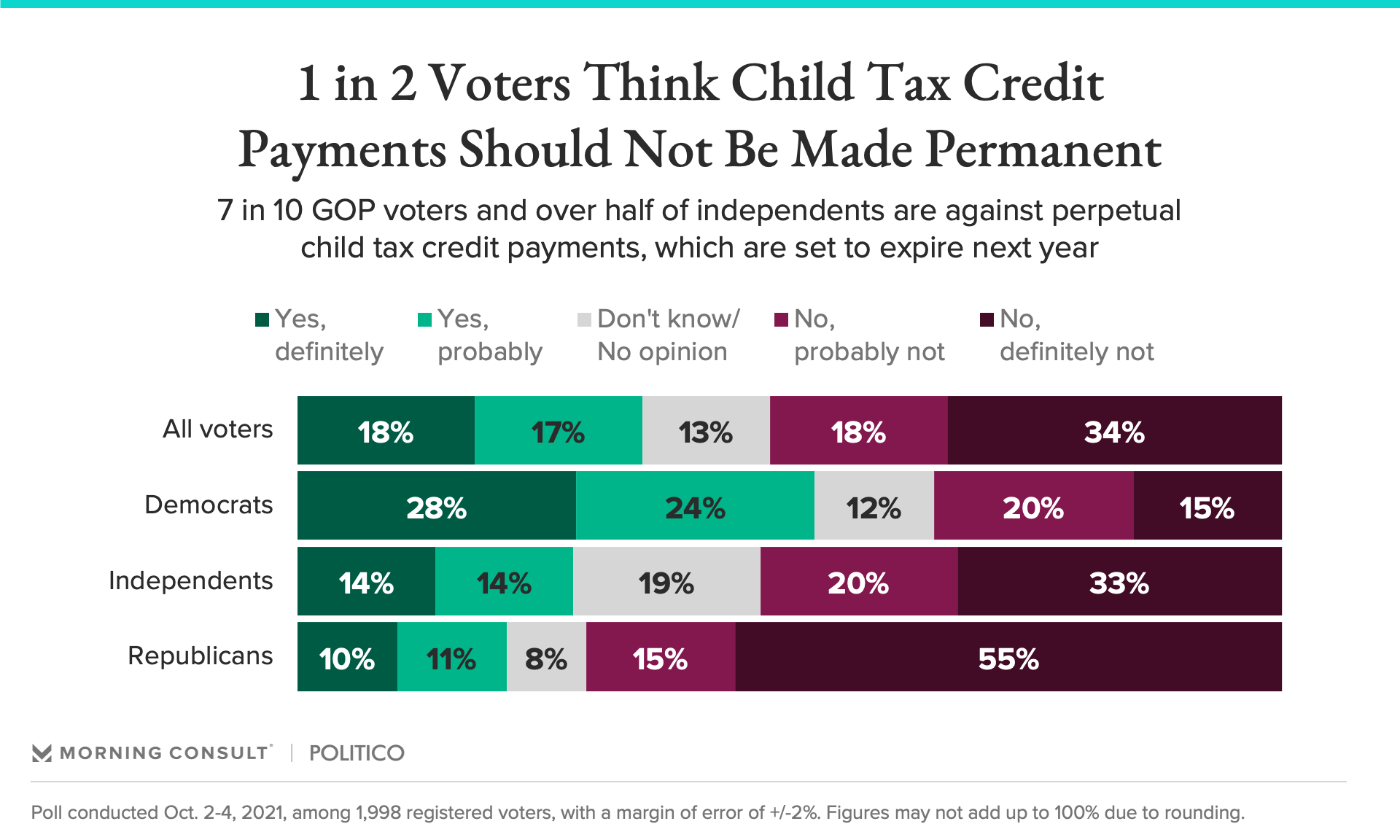

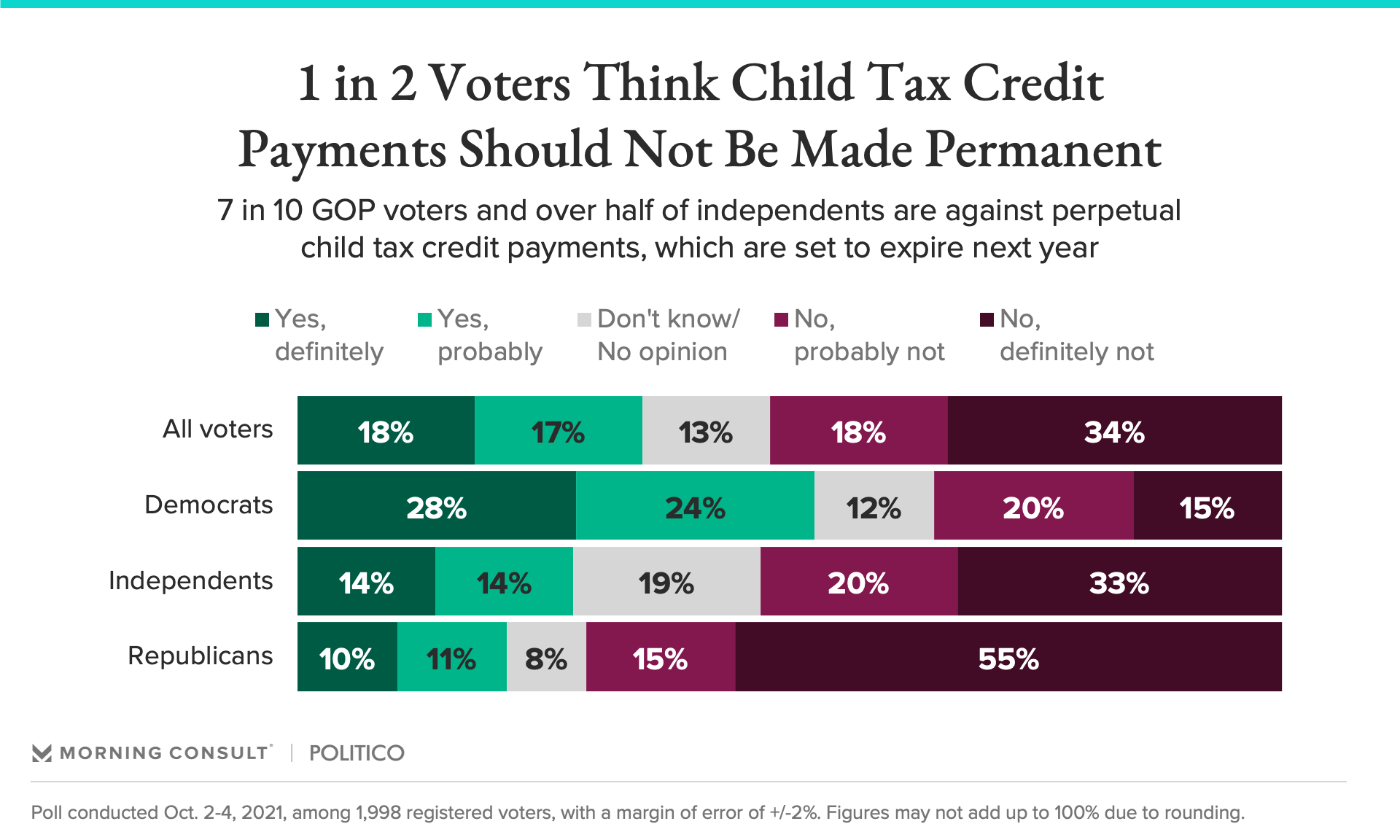

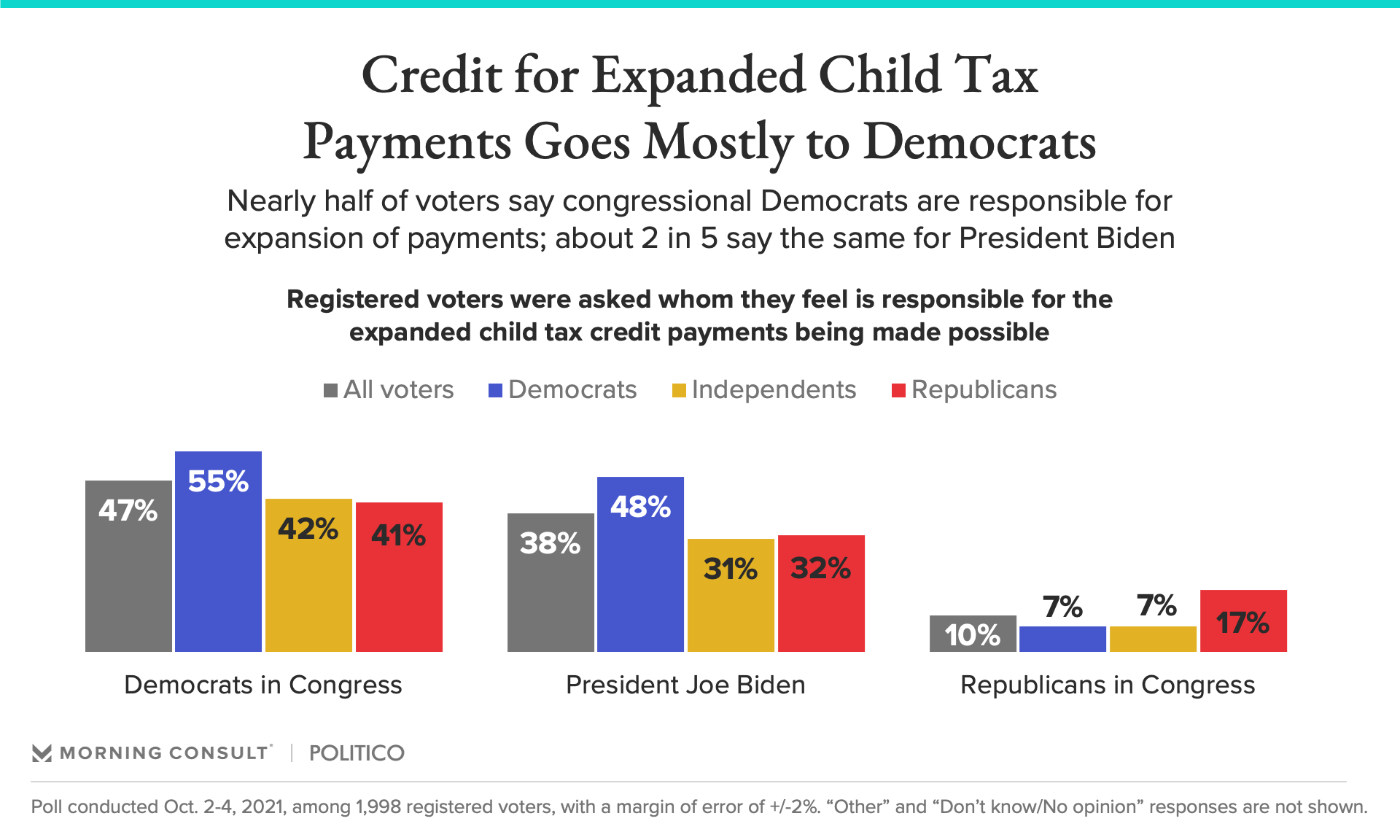

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Press Release Raise Income Threshold For Child Benefit Clawback To 60 000 Low Incomes Tax Reform Group

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize